Image

Insights

Coffee Break Column: Investment Director, Oki Shiozawa, discusses the introduction of new banknote designs set to be issued in Japan on July 3rd, and what these represent for Japan's Reiwa era.

Image

Insights

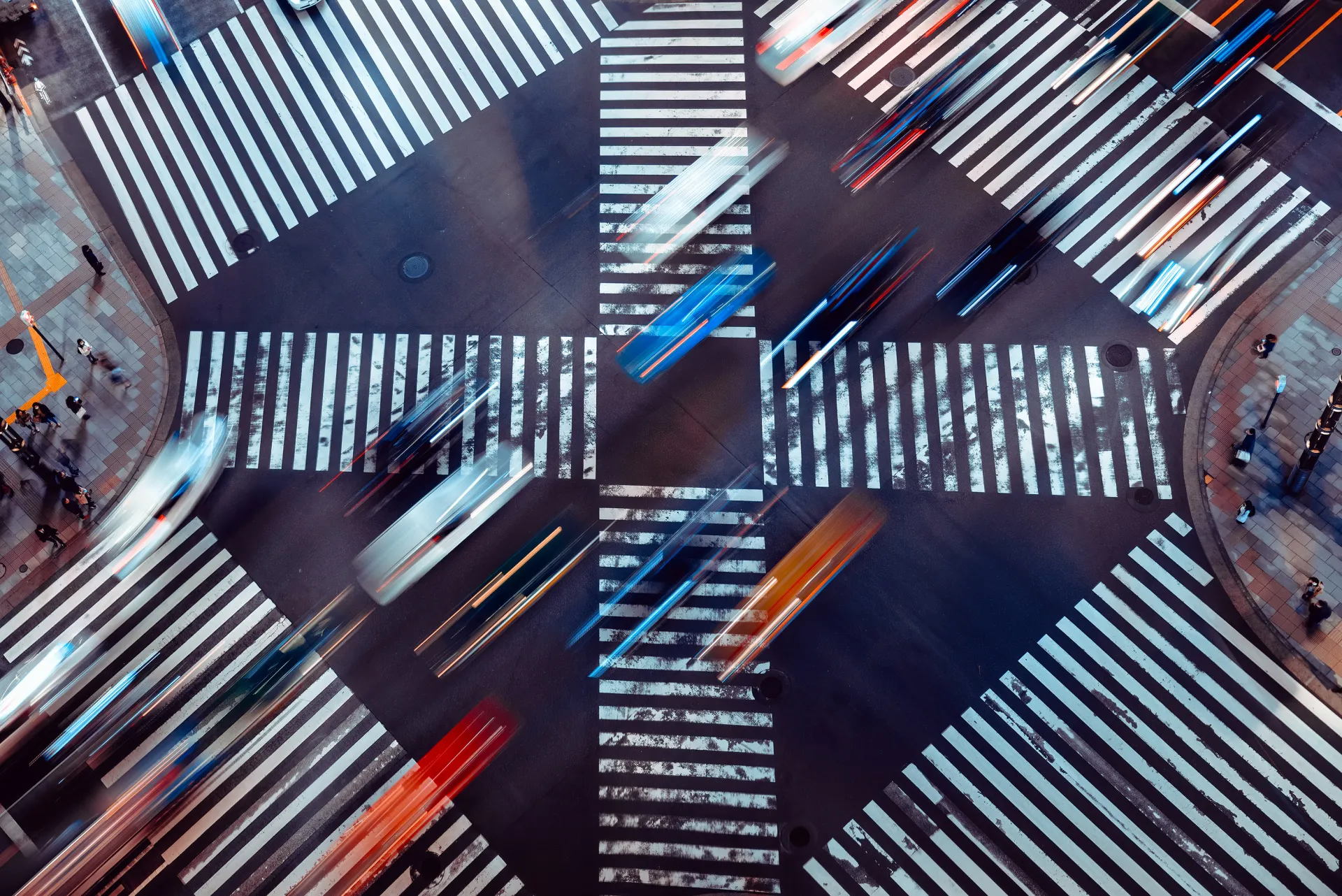

Sustainable Tourism on the Rise

Katsunori Ogawa, Chief Portfolio Manager - Sakigake High Alpha Strategy

Date: 22nd April 2024

Coffee Break Column: Katsunori Ogawa, Chief Portfolio Manager of Sakigake High Alpha, discusses the future of tourism in Japan and how sustainability will come into focus.

Image

News

Market Review for March 2024

Date: 2nd April 2024

In March Japanese equities continued their strong performance. The Nikkei 225 briefly reached the 41,000 yen level before returning to hover around the 40,000 yen mark. Gains were centred around large cap value stocks with foreign investors remaining net buyers of Japanese equities for the third month running.

Image

News

Japan's Monetary Policy Takes a Turn

Date: 19th March 2024

[EXTERNAL LINK] SuMi TRUST AM's Chief Strategist, Katsutoshi Indome's comments on the Bank of Japan's monetary policy shed light on the direction of Japan's economy.

Image

Insights

Wage Increases in 2024

Hiroyuki Ueno, Chief Strategist

Date: 13th March 2024

Coffee Break Column: Hiroyuki Ueno, Chief Strategist, discusses his outlook on wage increases in Japan in 2024 and what this means for the Bank of Japan's future monetary policy.

Image

News

Market Review for February 2024

Date: 4th March 2024

In February Japanese equities performed unprecedentedly well, bringing the Nikkei 225 to a historical high of 39,426 yen on the 27th February. This surge was primarily driven by positive corporate earnings announcements and the expectations for continuous monetary easing policies. Foreign investor trading volume continued to be high for the second month running, which was a supporting factor for the market.

Image

Press Release

SuMi TRUST AM Wins AAM 2024 Best of the Best Awards

Date: 16th February 2024

SuMi TRUST AM received awards in multiple categories in the Asia Asset Management (AAM) 2024 Best of the Best Awards.

Image

Insights

Japan’s Semiconductor Market Makes A Strong Comeback!

Katsunori Ogawa, Chief Portfolio Manager - Sakigake High Alpha Strategy

Date: 9th February 2024

In this article we will shed some light on semiconductors in Japan, focusing on industry trends and the efforts of the Japanese government, following the powerful message delivered by Prime Minister Kishida at the opening ceremony of SEMICON Japan.

Image

News

SuMi TRUST AM expands assets abroad on Middle East mandates

Date: 5th February 2024

[EXTERNAL LINK] In an article with Nikkei Asia, Yoshio Hishida, chief executive officer at Sumitomo Mitsui Trust Asset Management, discusses SuMi TRUST AM's presence in the Middle Eastern region, which accounts for 90% of the firm's assets from overseas.