Sumitomo Mitsui Trust Asset Management and Osmosis (Holdings) Limited Enter into Basic Agreement for Strategic Partnership

Sumitomo Mitsui Trust Asset Management Co., Ltd. (“SuMi TRUST AM”) together with Osmosis (Holdings) Limited (“Osmosis”) hereby announce that they have entered into a non-binding agreement for a strategic partnership, under which SuMi TRUST AM and Osmosis intend to collaboratively develop new products and strategies. It also includes a non-binding agreement for SuMi TRUST AM to prepare for acquiring a minority stake in Osmosis.

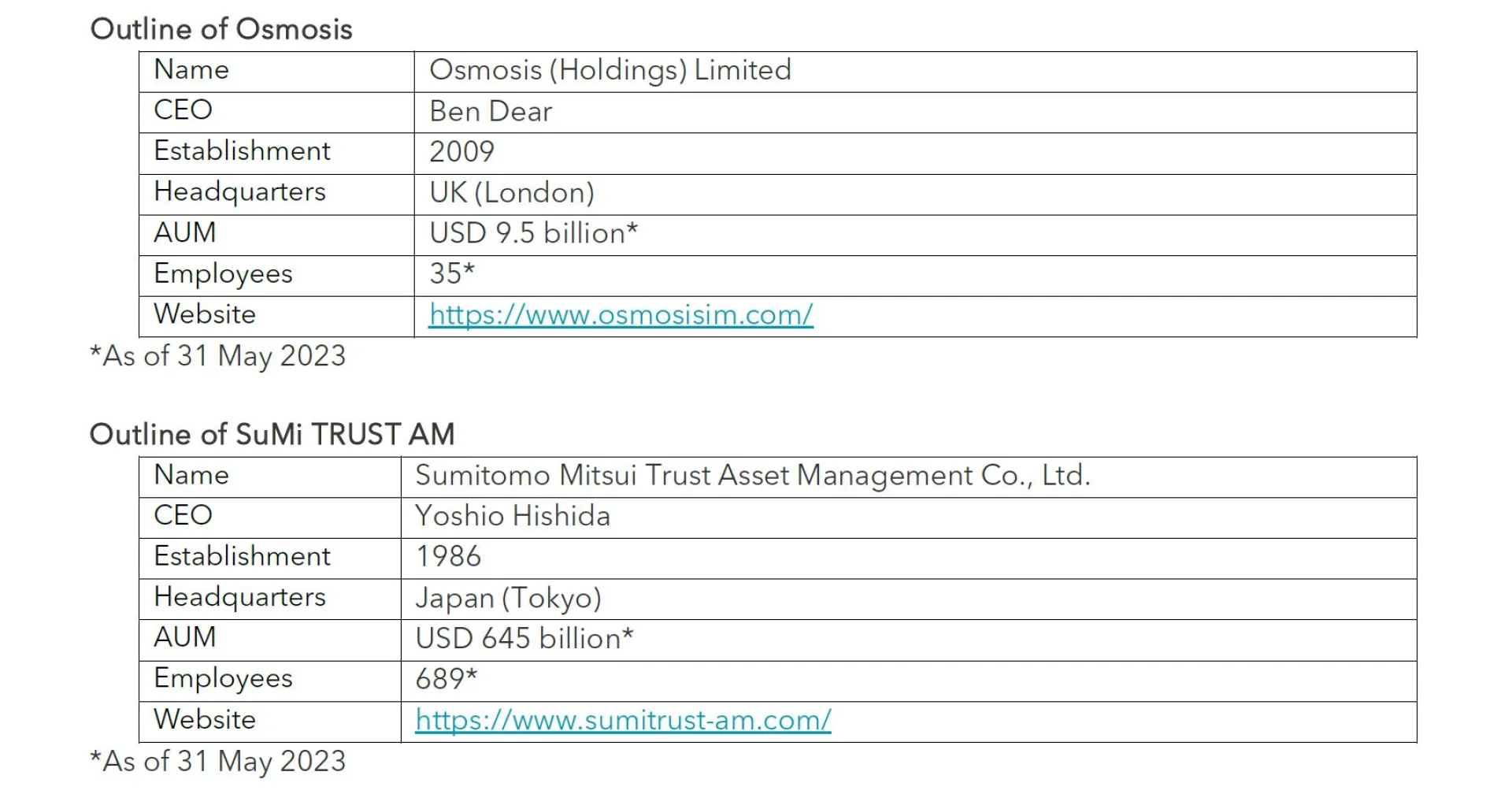

- About Osmosis

Osmosis, founded in 2009 and headquartered in London, is a research-based, quantitative investment manager focused on delivering superior investment returns with better environmental outcomes. Its investment philosophy is that companies that are more resource efficient are more likely to outperform their peers over the long term. The Osmosis portfolios overweight resource efficient companies and underweight, or short, inefficient companies as identified by the Osmosis Model of Resource Efficiency.

- Outline of the Strategic Partnership

SuMi TRUST AM and Osmosis have entered into a non-binding agreement to collaboratively develop new products and strategies, which may involve the collaboration between Osmosis and SuMi TRUST AM’s respective investment/research teams and the secondment of SuMi TRUST AM staff to Osmosis in order to promote speedy product development.

Regarding the strategic partnership, Osmosis CEO Ben Dear remarked, “Osmosis is excited to formalise this partnership with SuMi TRUST AM which is based on a shared vision of the scale of the opportunity, an alignment of values, and a belief that the capital markets have a pivotal role to play in directing capital towards those companies that are leading the transition to a more sustainable planet. Teaming up with SuMi TRUST AM will allow Osmosis to further raise awareness of our unique investment approach, which targets better risk-adjusted returns while significantly reducing the ownership of carbon, water and waste, in the Asia region.”

SuMi TRUST AM Representative Director and President, Yoshio Hishida commented, “Osmosis has developed an investment strategy based on the philosophy that companies with better Resource Efficiency, defined by the volume of ‘carbon emitted’, ‘waste generated’, and ‘water consumed’, create more economic value, and have outperformed their peers over the long term. This investment approach also gains academic acceptance. Osmosis is constantly reviewing and upgrading its investment strategy. Through collaboration, SuMi TRUST AM intends to learn from its attitude and passion and, by combining Osmosis's investment strategy with SuMi TRUST AM’s investment management skills, deliver more advanced investment strategies to investors and contribute to the advancement of the investment management business in Japan and the asset formation of investors.”

Disclaimer

This document has not been approved by or registered with any regulatory or governmental authority in any jurisdiction. The information and opinions contained in this document do not purport to be full or complete and do not constitute investment advice. All copyrights regarding this material, other than the parts quoted from other companies’ materials, belong to Sumitomo Mitsui Trust Asset Management Co., Ltd. This material may not be used or reproduced in part or in whole for any purpose without its express permission. Should you have any questions as to this material, please address them to the Global Business Development Department.