Additional stimulus to match the first supplementary budget, doubling the total amount

The second supplementary budget for FY2020, which includes additional measures for COVID-19, passed the Diet on 12th June. The size of the package is JPY 117.1 trillion, which is equivalent to the emergency economic measures (the first supplementary budget) announced on 20th April. However, the fiscal outlay in the second supplementary budget is JPY 31.9 trillion, surpassing the JPY 25.7 trillion announced under the first supplementary budget. Thus the total stimulus package designed to counter COVID-19, will double as a result.

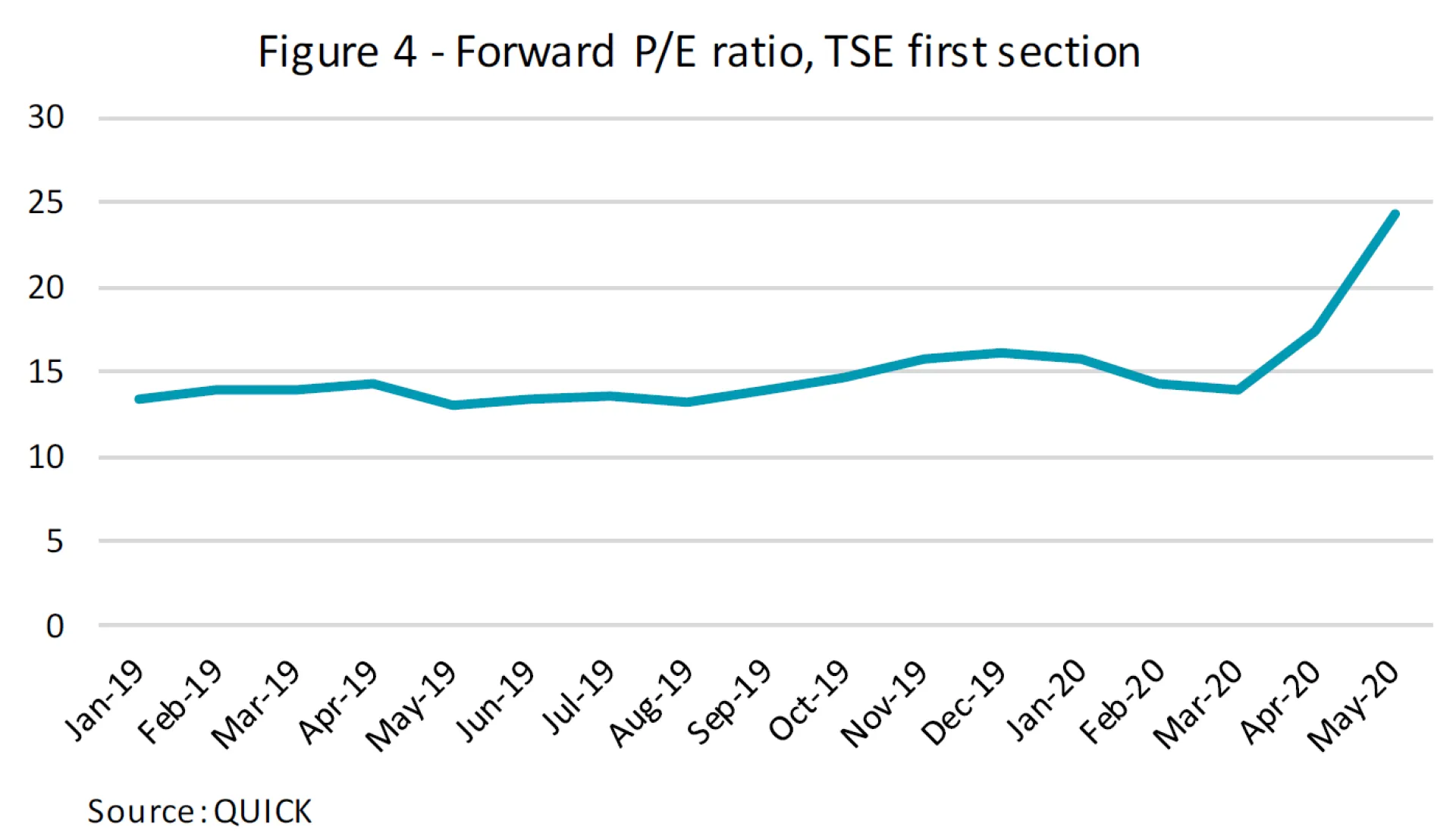

The combination of the first and second supplementary budgets is projected at JPY 234 trillion, which equates to 42% of GDP. Based on information released by the Ministry of Finance in June, Japan's economic stimulus measures are far greater than those of other advanced nations (Figure 1).

Employment stimulus package to avert long term economic damage

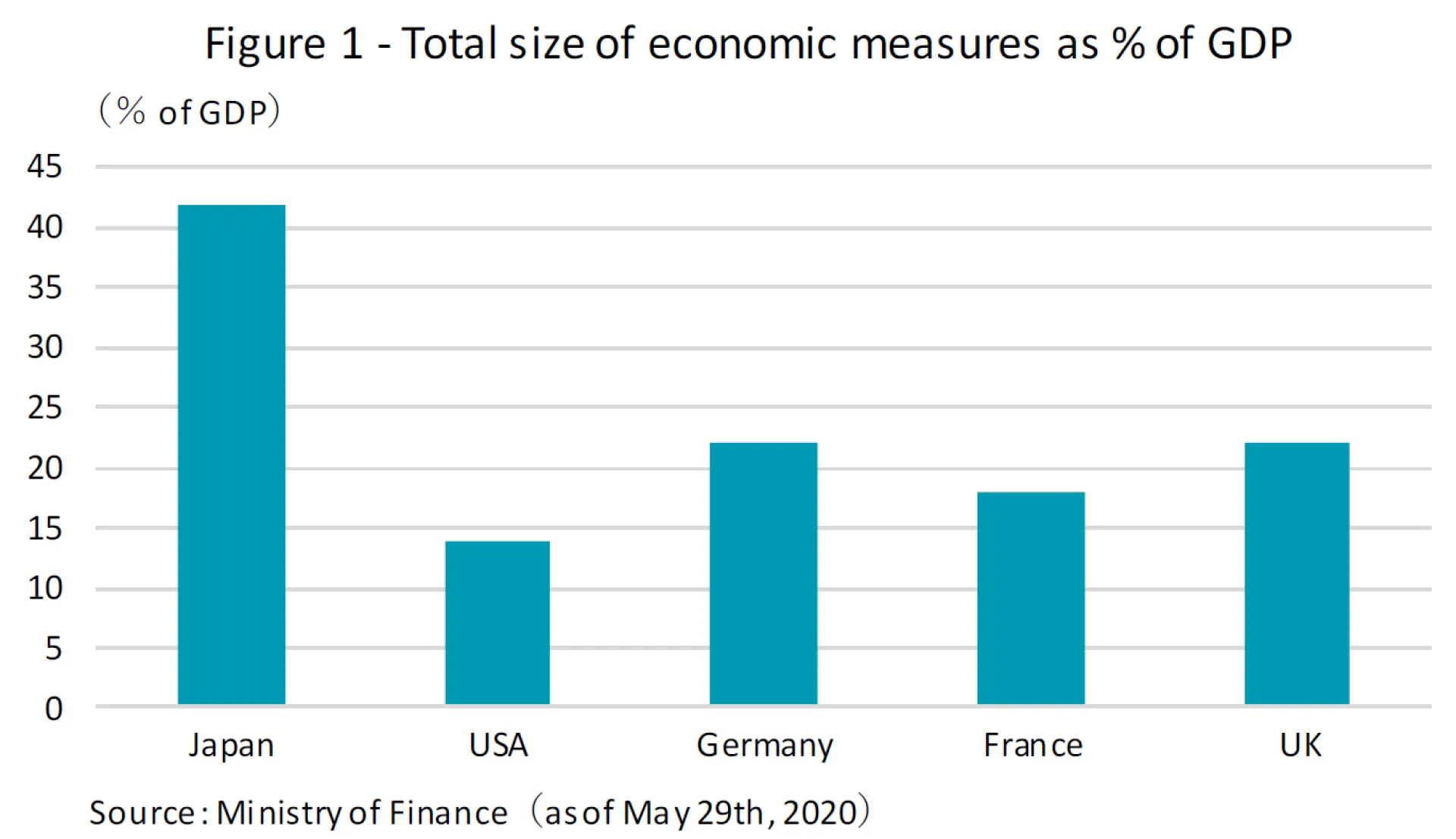

The second supplementary budget includes a larger fiscal outlay which includes higher employment adjustment subsidies to mitigate the negative impact from suspended economic activities. Today, the unemployment rate is increasing rapidly all over the world. According to the ILO (International Labour Organization), a 10.5% fall in employment is expected as compared to pre-crisis levels (Q4 2019) This is equivalent to a loss of 305 million full-time jobs, raising concerns of a prolonged personal consumption slump. In Japan, in tandem with global trends, the number of those employed has fallen significantly, especially among the young and elderly generation (Figure 2). In addition, the number of workers on temporary leave* is approximately 6.0 million, a significant increase of 4.2 million from the previous year (Figure 3). This is probably because companies have been struggling with labor shortages associated with changes in the demographic structure for the past few years and are trying to preserve employment in as much as possible. Recently, delays in distributing various subsidies have become a social problem. Prompt and timely payment is essential for a smooth reactivation of the economy.

* Workers who are on temporary leave must be paid at least 60% of the usual monthly salary by law.

Massive fiscal stimulus for SME’s

In addition to a JPY 60 trillion fiscal funding program, public funds will be made available to prevent companies from losing shareholder’s equity. Compared with measures under the first supplementary budget in April, the second supplementary budget is aimed at minimizing the long term effects of COVID-19.

Even with the contagion under control, consumption stimulus measures will still be needed. Under the first supplementary budget, the government launched the “Go To campaign” which included the “Go To Travel campaign” that subsidizes half the cost of a holiday trip for up to JPY 20,000 per person, “Go To Eat campaign”, a rebate program of up to JPY 1,000 for those making reservations online, and “Go To Event campaign”, a rebate program of up to 20% of the ticket price for entertainment events such as concerts, performing arts, exhibitions and sporting events.

Fiscal sustainability

As a result of the large-scale fiscal stimuli, Japan will extend its record debt-to-GDP, the highest among advanced countries. However, we do not expect this to raise alarm bells for the Japanese market as around 90% of Japanese government bonds (JGB) are held by domestic entities including the Bank of Japan (BoJ) and financial institutions. In addition, the BoJ has suppressed interest rates through its Yield Curve Control policy. As long as the current BoJ policy and the composition of major JGB holders are sustained, we believe that it is unlikely that a debt crisis will occur in Japan.

Stock market reaction

Turning our eyes to equities, the market as a whole has recovered by over 30% from the bottom, based on the optimism over resuming economic activities after the pandemic. Even share prices of industry groups heavily impacted by the virus, such as travel agents or restaurants/pubs, have recovered from their bottom. We observed a sharp fall in June after a rise in COVID-19 cases in the US, but the Nikkei225 remained firm at around 22,000.

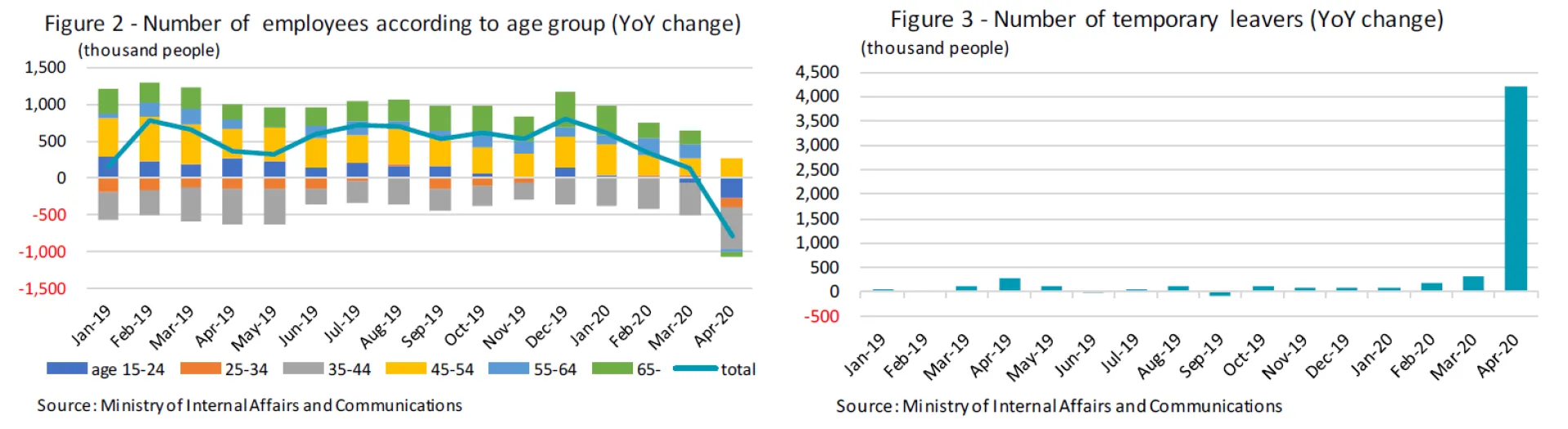

On the other hand, we expect earnings in many sectors to decline more than the share prices imply. The latest forward P/E ratio seems to have jumped (Figure 4), making it difficult to measure equity valuations. We believe this is because investors have already discounted the negative impact on earnings for the current fiscal year ending March 2021, and are looking at a recovery to be reflected in earnings for the next fiscal year ending March 2022 and onwards. It has become increasingly important to assess a company's business model and its mid- to long-term growth potential in these uncertain times.