Source: Prepared by SuMi TRUST AM based on publicly available information on Toshiba Machine (now Shibaura Machine)

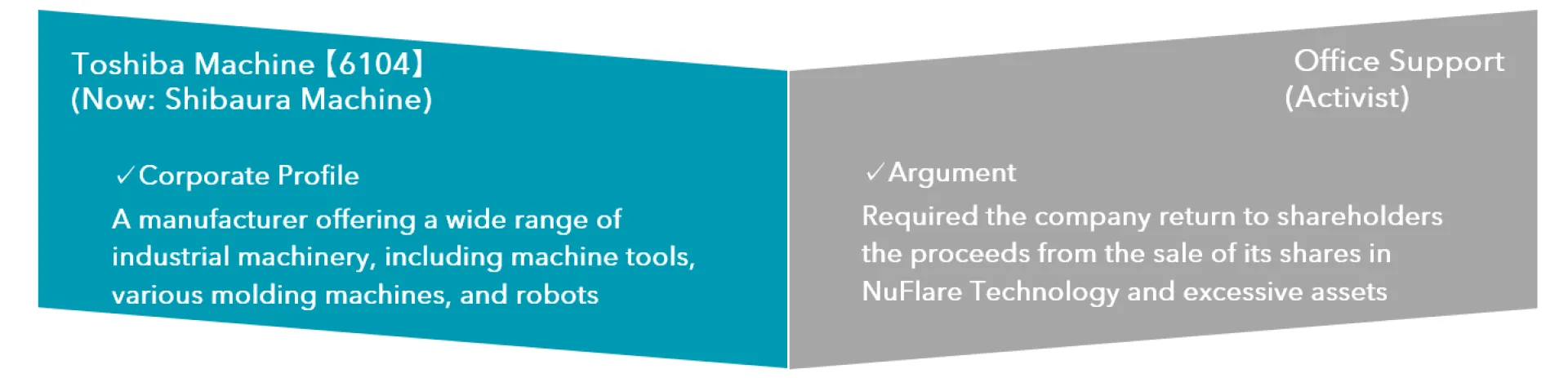

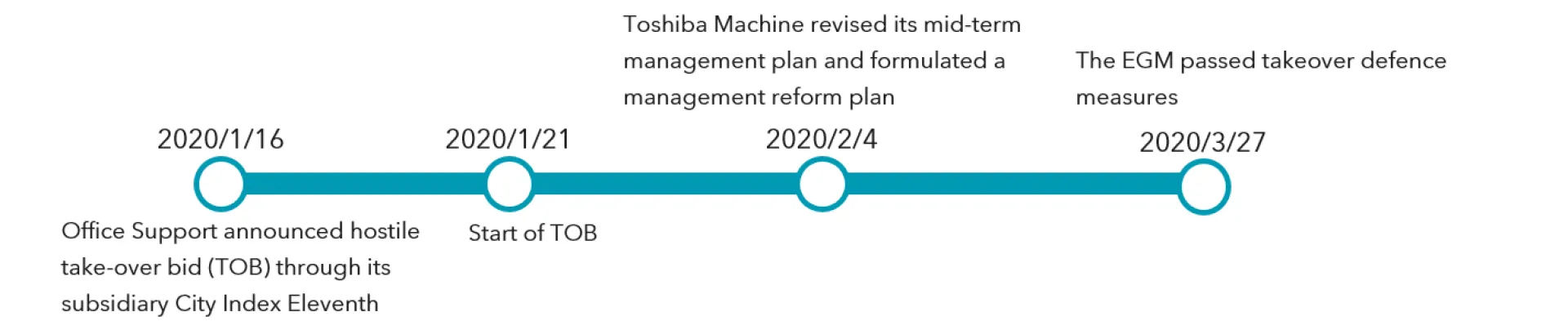

Background to the EGM: Office Support launched a takeover bid (TOB) without Toshiba Machine's consent. In turn, Toshiba Machine introduced anti-takeover measures.

Source: Prepared by SuMi TRUST AM based on publicly available information on Toshiba Machine (now Shibaura Machine)

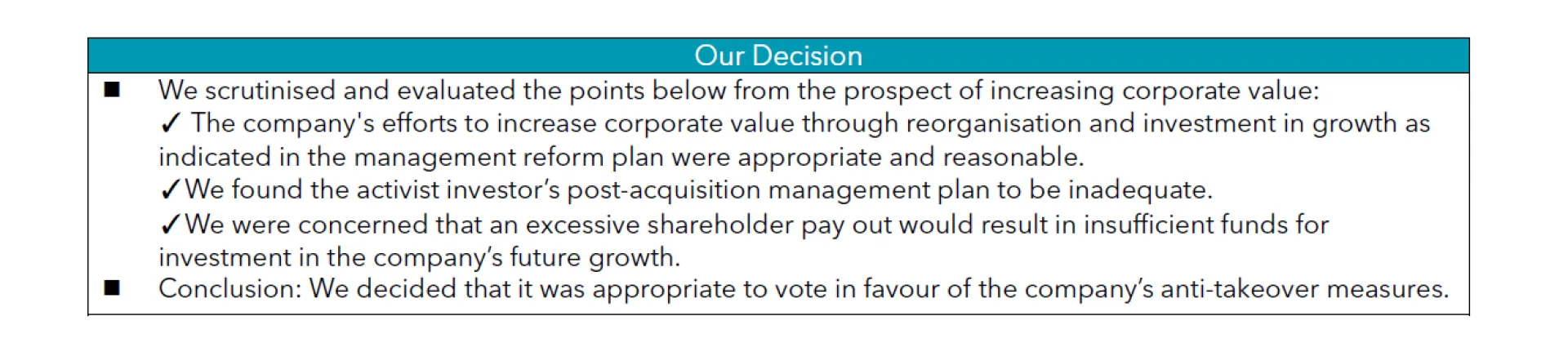

Basis for our voting decision: As this case was categorised as anti-takeover measure and an emergency situation, we exercised our vote based on which option would contribute to improving corporate value if it were implemented: the company’s management reform plan (formulated by its management prior to the EGM) or the activist’s claims.

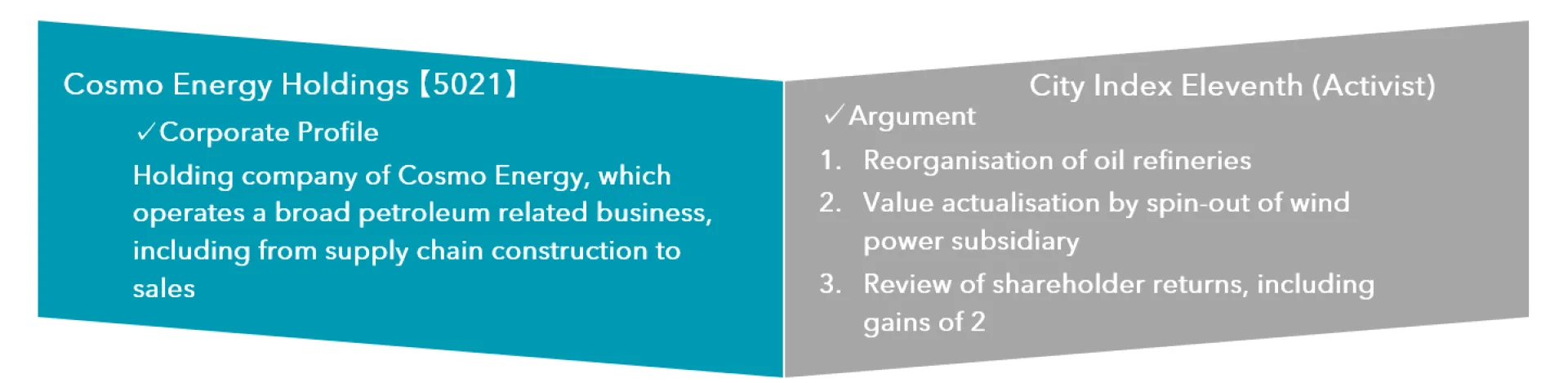

Case 2: Cosmo Energy Holdings

Cosmo Energy Holdings asked its shareholders at its annual general meeting (AGM) whether to activate anti-takeover measures in preparation for a TOB by an investment company named City Index Eleventh (AGM of June 2023)

Company and Activist Investor

Source: Prepared by SuMi TRUST AM based on publicly available information on Cosmo Energy Holdings and City Index Eleventh

Background to the AGM: With City Index Eleventh holding more than 20% of the company's shares, Cosmo Energy Holdings voted to activate anti-takeover measures in preparation for further purchases by the investor.

Source: Prepared by SuMi TRUST AM based on publicly available information on Cosmo Energy Holdings

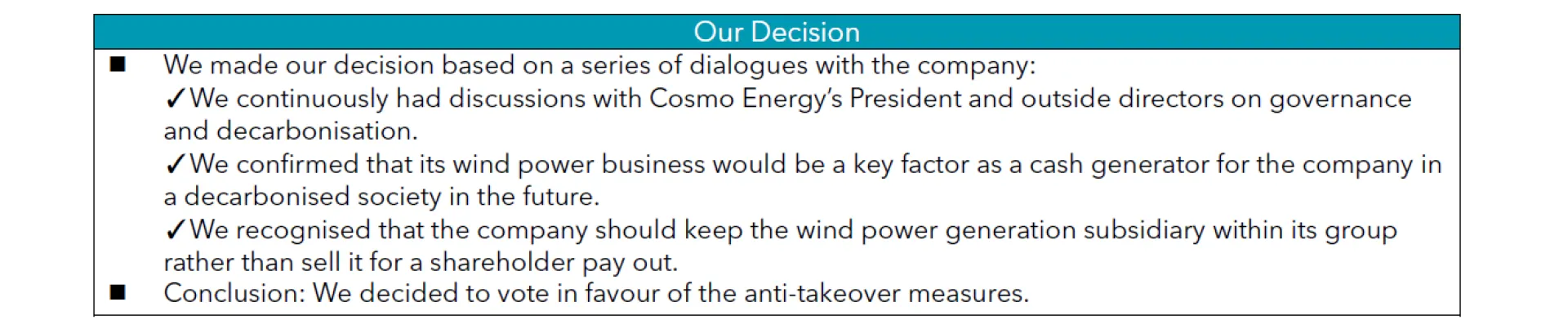

Basis for our voting decision: We made the decision to exercise our vote based on our ongoing dialogue with the company as the event was categorised as an emergency situation involving anti-takeover measures. In particular, our dialogue about the company's business transformation toward a decarbonised society gave a solid foundation for our decision-making process because it demonstrated the connection between its wind power generation subsidiary and the company’s future corporate value.

Looking Ahead

Here we have presented two examples of our decision-making process relating to anti-takeover measures. In both cases, we took an individual approach to make our final decision based on close examination of the facts and a series of dialogues with the investee companies and their newly presented strategies with consideration for what is required to enhance their corporate value.

As investor activism becomes more prevalent in Japan, not only investee companies but also asset management firms are under pressure to deal with increasingly complex issues requiring thoughtful consideration. We have put in place an effective system to respond promptly and adequately, including acquiring a variety of knowledge and information through our global offices, domestic and international initiatives, and other stakeholders. We will continue to work to increase the corporate value of our investee companies as well as the value of the assets entrusted to us by our clients.

[1] Our policy on the exercise of voting rights: Proxy Voting | SuMi Trust Asset Management (sumitrust-am.com)